Some Known Questions About Paul B Insurance.

Wiki Article

Paul B Insurance Can Be Fun For Everyone

Can not get or utilize different supplementary coverage (like Medigap). You have to have both Part An and also Component B to join a Medicare Benefit Plan. When you have Medicare and other medical insurance (like from your work), one will certainly pay initial (called a "key payer") and also the other second (called a "secondary payer").

:max_bytes(150000):strip_icc()/basics-to-help-you-understand-how-insurance-works-4783595_final-9cf74d5b66d14f88a21ab29ddb290e2d.png)

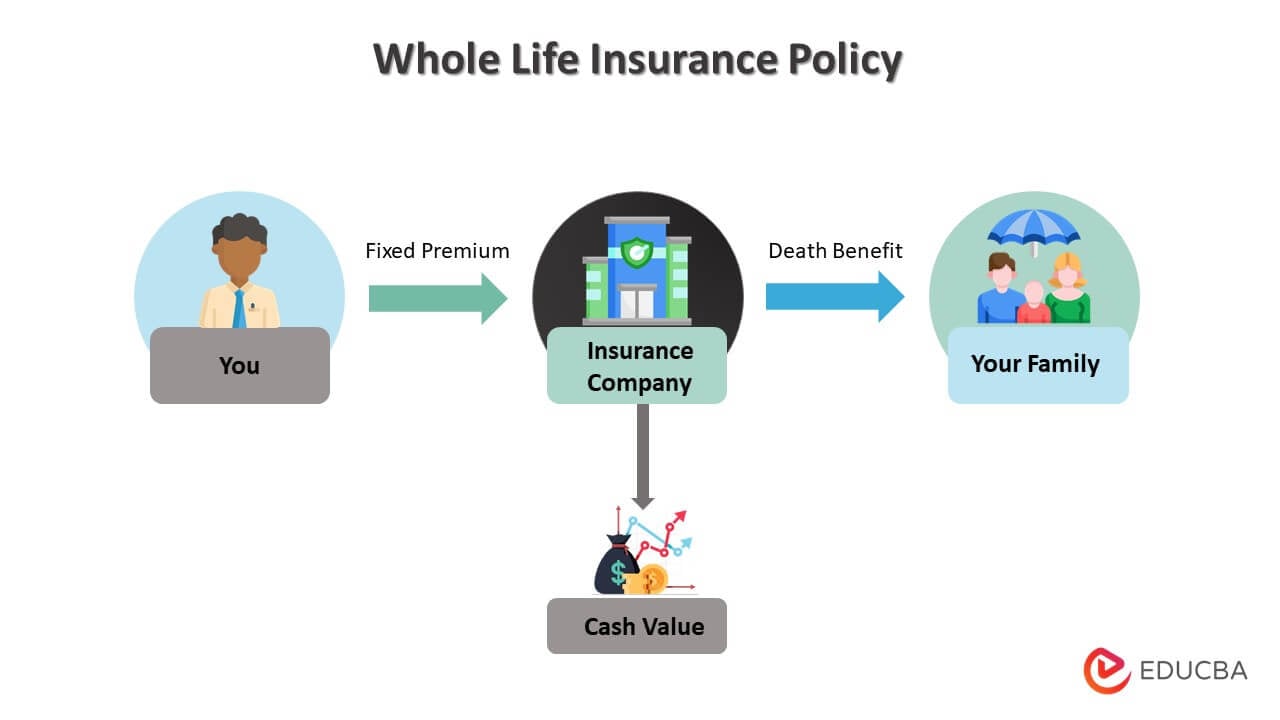

Life insurance policy is an arrangement between you (the insurance policy holder) as well as an insurance business that pays out if you pass away while the plan is in pressure. The objective is to offer a economic safety and security web, so your family or liked ones will not need to bother with paying costs, last expenses, or other monetary obligations in the lack of your revenue.

After you die, your beneficiaries may after that utilize the fatality benefit payout to cover all kinds of costs or financial obligation, consisting of: End-of-life costs as well as funeral expensesEstate planning costs, Monthly bills and also home mortgage settlements, Youngster treatment as well as university tuition, Medical expenditures, Other monetary responsibilities Many life insurance policy companies do not cover death by self-destruction within the first two years the plan is in pressure.

Little Known Facts About Paul B Insurance.

We do not sell your information to 3rd parties. Term, whole, universal, variable, and also final expense insurance are the 5 main kinds of life insurance policy policies on the marketplace though there are lots of extra subtypes. Term life insurance policy is one of the most preferred and budget-friendly kinds of insurance coverage. It's a straightforward plan that lasts for a particular variety of years generally 10 to 30.

his response

49% of the sandwich generation don't have life insurance policy, A recent Policygenius survey located that 49% of the sandwich generation (people with a parent age 65 or older that also are elevating children or sustaining grown-up children) doesn't live insurance to aid economically sustain their loved ones after they die.

Life insurance policy prices go up anywhere from 4. Your gender, Because ladies usually live longer than males, covering females offers much less near-term risk to an insurance policy firm.

A Biased View of Paul B Insurance

The insurance firm, the insurance holder, the fatality benefit, as well as the beneficiaries are some of the major elements of a life insurance coverage plan. Below you'll locate a full listing of the parts of a life policy and what they suggest.

The insurance holder, The policyholder is the proprietor of the life insurance plan. The insurance holder pays the costs and preserves the plan.

like this

When they pass away, the life insurance company pays out the survivor benefit. The death benefit, The survivor benefit is the quantity of cash the beneficiaries get if/when the insured dies. It's most frequently paid as a tax-free round figure. The beneficiaries, The beneficiaries are the individuals that get the survivor benefit when the insured passes away.

How Paul B Insurance can Save You Time, Stress, and Money.

The plan size, The plan length describes for how long the policy will certainly be energetic. With term plans, this is generally 10-30 years. Irreversible plans last your entire life several enhance, or mature, at age 100. The costs, The premium is the cash you pay to keep your plan energetic.

The cash money worth, The money worth is a feature that features many irreversible life insurance policy plans it supplies a separate account within your policy that gains passion at a set rate. The longer you have actually been paying right into your policy, the greater your money value will certainly be. The motorcyclists, Bikers are optional attachments you can use to personalize your policy.

With other riders you'll pay added for example the child biker, which comes with an added, smaller fatality benefit to cover your youngsters in case they die. You should select a recipient who's economically linked to you, or that you can trust to obtain the survivor benefit in your place.

The Best Strategy To Use For Paul B Insurance

If your kids are minors, you can also note a member of the family that would be their guardian in your absence. Nonetheless, Policygenius recommends utilizing estate preparation devices like depends on to ensure the cash is made use of the means you want it to be utilized. Most costs can be paid on a month-to-month or annual basis.

Some business will allow you to pay with a debt card for recurring settlements, yet this is less usual and also it depends on the insurance company. Your beneficiaries will require to gather crucial papers such as the death certification as well as the existing life insurance plan papers.

Recipients can pick to get the survivor benefit in several various types, a lot of generally in a swelling sum or installments. When you receive the advantage in a round figure, it'll be tax-free. Choosing to receive the advantage in installations is also tax-free, although you'll pay income tax obligation on any kind of rate of interest gotten by the staying sum of cash held by the insurance firm.

description

Paul B Insurance for Beginners

Is life insurance policy a good financial investment? Life insurance acts as a monetary safeguard for your liked ones as a key function. Irreversible life insurance coverage items do have an investment component, yet it's best to speak to a financial consultant since there are various other traditional financial investment techniques that are much less risky as well as usually produce higher returns.

Sharing, or merging, of threat is the main concept of the company of insurance policy. If riskschances of losscan be split amongst several members of a group, then they need fall but gently on any type of single participant of the team.

The suggestion, and also the technique, of risk-sharing come from in antiquity. Countless years have expired given that Chinese sellers created a resourceful method of securing themselves against the possibility of an economically crippling upset in the treacherous river rapids along their profession courses. They just split their freights among a number of watercrafts.

Some Ideas on Paul B Insurance You Should Know

Each stood to lose only a little part. They might not have considered their scheme as insurance coverage, but the concept is extremely comparable to that of its modern equivalent, ocean marine insurance, as well as to that of various other kinds of residential or commercial property and also casualty insurance policy. With modem insurance policy, nonetheless, rather than actually distributing cargoes among a variety of ships, merchants and also shipowners find it easier to spread the monetary prices of any losses amongst lots of merchants and also shipowners with using economic arrangements.

Report this wiki page